The following article was written for MyInd Makers. Pasting it here for reference:

“Reverse Bank of India” is the new joke going around for last few days. On December 21, the English language media was thrilled to bits when RBI withdrew a decision, following feedback from the ground. As is their wont, they claimed this “dented RBI’s credibility”. They claimed Urjit Patel is incompetent, Rockstar Raghuram Rajan is being missed, U-turns by RBI has “dented” its credibility etc. They also claimed that RBI changed rules 60 times in the last 42 days.

So, I went about digging data from RBI’s official website. The full list of November notifications can be found here: https://www.rbi.org.in/scripts/notificationuser.aspx . The full list of December notifications can be found here: https://www.rbi.org.in/scripts/notificationuser.aspx# (In case you are having difficulties, you can just click on “2016” on the right side of the link).

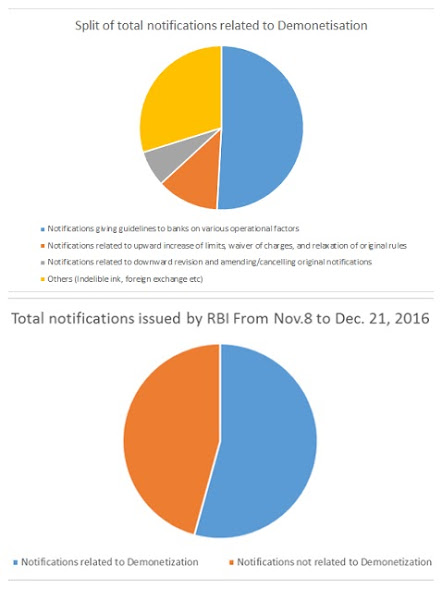

While a detailed summary is presented towards the later part of the article, here is a top-level summary (some numbers might be a little off here and there, because all of this is manual counting):

Total Notifications issued

|

105

|

Notifications related to Dmonetization

|

57

|

| Split of these 57 notifications | |

Notifications giving guidelines to banks on various factors

|

29

|

Notifications related to upward increase of limits, waiver of charges, and relaxation of original rules

|

7

|

Notifications related to downward revision and amending/cancelling original notifications

|

4

|

Others (Indelible ink, foreign exchange, Garib Kalyan Yojana, etc)

|

17

|

7 of the 57 notifications are related to just the announcements made by the Prime Minister of India. Banks have been given guidelines on various factors like cash in the bank chests, CCTV recordings, fraudulent practices, electronic services, reporting and monitoring, Jan Dhan accounts etc. There have been nearly 7 notifications that have either relaxed existing guidelines or have revised upwardly the withdrawal/exchange limits.

There were widespread complaints and feedback that the exchange facility was being misused. The Government and RBI had no option but to think on their feet, and therefore the exchange option had to be withdrawn. Whilst the likes of Shekhar Gupta liked to call this as an ambush, this move indicated that the government is receptive to feedback and will not hesitate to take a tough call.

The next widespread complaint came on December 19th, when the Government and RBI issued a notification saying that citizens can deposit their old notes only once, if they are depositing more than INR 5000. There is no harm in such a decision – after all, why would you want to go to bank multiple times. The trouble however was that an explanation was sought as to why this money was not deposited till now, in front of 2 bank officials! This was clearly an overhead and unwarranted restriction – the Government listened and called it off, within a day!

Every single rule change was based on feedback from the ground – most of it in the positive way. Every possible resource was deployed so that money reaches the citizens – and a massive exercise of this size will obviously face some hardships. To glorify them, and use words like “stupid”, “idiotic”, “credibility lost” is nothing but exposing one’s impatience.

Following is a detailed split of various notifications by the RBI. For ease of consumption, I have split the analysis into blocks of 3 days each.

- November 8th to November 10th:

- Total Notifications issued: 14

- Notifications related to Demonetization: 7

- 1 of them is about the “Withdrawal of Legal Tender Character of existing 500/- and ₹ 1000/- Bank Notes” (Duh!)

- 2 of them are about being open on Saturday and Sunday

- 2 of them relate to closure and recalibration of ATMs

- 1 is about the limits, as announced by the Prime Minister on November 8th.

- November 11th to November 14th:

- Total Notifications issued: 13

- Notifications related to Demonetization: 8

- Salient points of these 8 notifications:

- 2 of them relate to “Reporting and Monitoring” – No impact on General public

- Revision of limit (Exchange limit increased to 4500, ATM to 2500)

- Expansion of distribution locations

- Waiver of Customer charges

- Applicability to DCCB

- Notifications related to Auctions: 5

- November 15th to November 18th :

- Total Notifications issued: 9

- Notifications related to Demonetization: 5

- Salient points of these 5 notifications

- Indelible Ink introduced to prevent mis-use of exchange limits

- Revision of exchange limit to 2000 from earlier 4500 (Again to prevent mis-use of exchange limit)

- Relaxation of withdrawal limits at POS

- November 19th to November 22nd :

- No notification on 19th

- Total Notifications issued: 14

- Notifications related to Demonetization: 7

- Salient points of these 7 notifications:

- Wedding cash rule, and modification of one sub-rule within a day (after feedback from various quarters online too!

- 2 notifications related to farmers and traders

- Notifications related to Auctions: 5

- November 23rd to November 26th :

- Total Notifications issued: 10

- Notifications related to Demonetization: 6

- Salient points of these 6 notifications:

- Cash exchange over the counter stopped.

- Withdrawal limit from accounts in banks increased from 20,000 a week to 24,000 a week. 10,000 daily limit withdrawn.

- November 27th to November 30th :

- Total Notifications issued: 10

- Notification related to Auctions: 5

- Notifications related to Demonetization: 5

- Precautions for JDY accounts (given the inflow of information that JDY accounts are being used to dump black money!

- December 1st to 5th :

- No notification on 3rd and 4th.

- Total Notifications issued: 10

- Notifications related to Demonetization: 5

- Nothing that affects general public

- Total Notifications related to Auctions: 5

- December 6th to 9th :

- Total Notifications issued: 8

- Notifications related to Demonetization: 4

- Salient features of these notifications

- Reactivation of dormant accounts

- KYC amendments

- December 12th to 15th

- Total Notifications issued: 5

- Notifications related to Demonetization: 3

- Salient features of these notifications

- Preservation of CCTV recordings

- Detection of counterfeit notes

- December 16th to 19th

- Total Number of Notifications issued: 11

- Notifications related to Demonetization: 6

- 2 of them relate to PM Garib Kalyan Yojana

- 1 of them is about Merchant Discount Rate

- 1 of them is the limit of only one time deposit for amounts >5000, with explanation

- Notifications related to Auctions: 5

- December 21st

- Withdrawal of the limit of 5000

0 comments:

Post a Comment